Did you receive a Form 1095-A from Access Health CT (AHCT)? It’s an important form that the primary tax filer in your household will need to file your household’s federal income tax return. If you or anyone in your household were enrolled in a Qualified Health Plan (QHP) in this last year, you should get a Form 1095-A in the mail (you can also access the Form in your AHCT online account inbox). Your Form should arrive in the mail by late January or early February. If you do not receive this Form by the third week of February, contact AHCT. You might receive more than one Form depending on the types of changes you reported to AHCT. For example, if you added a newborn to your coverage, or if a household member passed away but other members remained enrolled in coverage, you will likely get more than one Form.

FORM 1095-A IS AN IMPORTANT DOCUMENT ─ SAVE IT. You need your Form 1095-A to complete IRS Form 8962, which you must file with your federal income tax return. You need to file Form 8962 even if you did not receive financial help (Advance Premium Tax Credits) or were only enrolled in a QHP for part of the year. Learn more here.

Now, let’s review the different parts of the form:

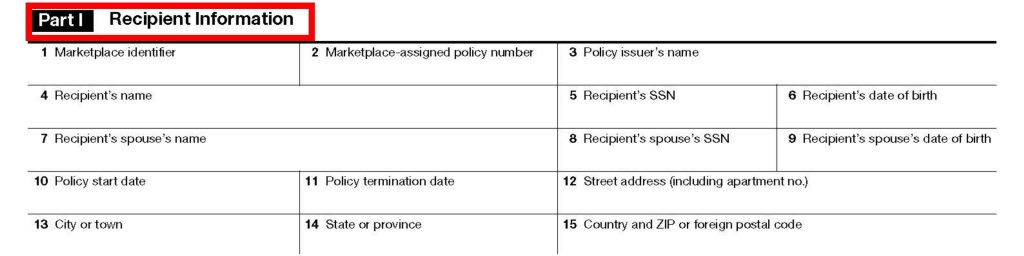

Part I: “Recipient Information.” The first part of the Form displays your personal information, such as your name, address and Social Security number. Part I also shows when you had health insurance, including start and end dates, your insurance company and your policy number. If you are married, your spouse’s information will also appear in Part I. Pay close attention to Part I, box 10 — make sure the policy start date matches what you have in your records. Call Access Health CT immediately if there is an error in your Form 1095-A.

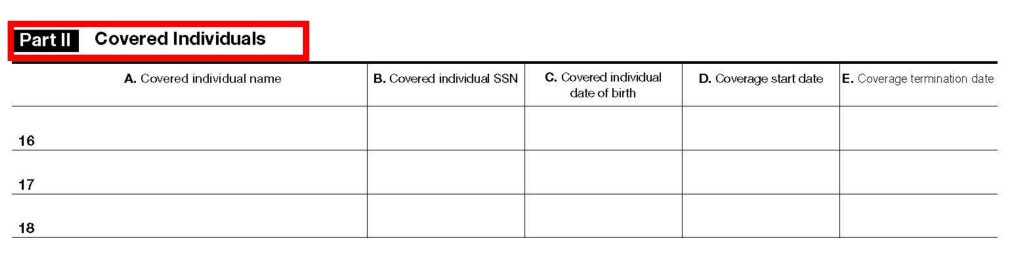

Part II, “Covered Individuals,” reports the information of anyone else in your household who was enrolled in a QHP in this last year. This may include a spouse, domestic partner or child.

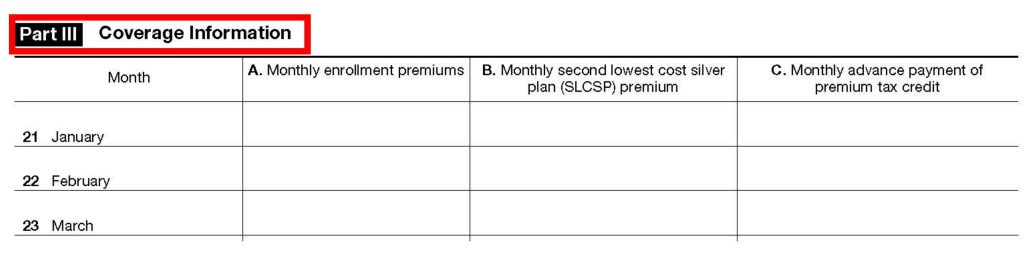

Part III, “Coverage Information,” shows your total monthly premium and the monthly amounts of financial assistance (Advance Premium Tax Credits) that was paid to your insurance company on your behalf. You will use this information to complete Form 8962, which you must file with your federal income tax return.

Make sure you carefully review Part III. If there is a difference in the amounts shown versus what you actually received, or if you notice any other possible error in your Form 1095-A, contact Access Health CT right away.

Review columns A, B, and C to see if they reflect all the changes you reported during the year. Do not worry if the amount shown in Column A is less than your actual premium! All QHPs sold through Access Health CT are required to cover Essential Health Benefits (EHBs), and this column only reflects the part of your premium that covers those specific benefits.

Checklist:

- REVIEW: Make sure all the information in your Form 1095-A is correct and up to Pay attention to dates and other personal household information! You might receive more than one Form, depending on the changes you reported in this last year.

- CONTACT: Call Access Health CT immediately if there is an error in your Form 1095-A.

- KEEP: Your Form 1095-A with your other tax documents because you’ll need it to prepare your federal income tax.

NOTE:

- Individuals enrolled in a Catastrophic plan or in HUSKY/Medicaid will not receive a Form 1095-A.

- HUSKY/Medicaid enrollees will receive IRS Form 1095-B from the Connecticut Department of Social Services (DSS).

- HUSKY/Medicaid customers will not automatically get Form 1095-B from If you want DSS to mail Form 1095-B to you, request the Form online or contact DSS.

Still have questions?

Whether you have questions about your eligibility, comparing plans, or want to see if you qualify for financial help, our team is ready and available to assist you. Remember, all help is free!

- Visit our website at AccessHealthCT.com/get-help/

- Live chat: AccessHealthCT.com; click “Live Chat” icon

- Phone: 1-855-805-4325; customers who are deaf or hearing impaired may use TTY at 1-855-789-2428 or call with a relay operator (we speak over 100 languages).

- Visit one of our Enrollment Locations

- Find a Broker or CAC near you